Know Your Customer or KYC: What is it, and how can it benefit you?

KYC is an essential tool within the business world. It’s beneficial for digital commerce and online transactions and is vital to combat illegal transactions.

What is Know Your Customer (KYC)?

The acronym KYC refers to "Know Your Customer", a process that consists of verifying the identity of your clients through the verification of data following legal requirements and the data that Critical.net obtains from each transaction and its internal databases.

In addition to knowing what KYC stands for, it is wise to recognize its importance. The value of "Know Your Customer" allows for a better relationship with customers and helps your online business avoid fraud risks associated with the concealment of customer identity.

Know your customer (KYC) as an anti-fraud measure

Online merchants must include the know-your-customer process as part of their anti-fraud system. This helps to correctly identify online buyers, helping alleviate the fact that they're not physically present at the time of purchase.

By verifying your customers, you will be able to more easily identify the real users from the fake ones, thus avoiding fraudulent orders and the consequences of chargebacks. In addition, thanks to Critical.net, you can discourage future criminal attacks on your online business.

No matter how scammers try to hide their identity, we go one step further.

How does the Know Your Customer (KYC) procedure work?

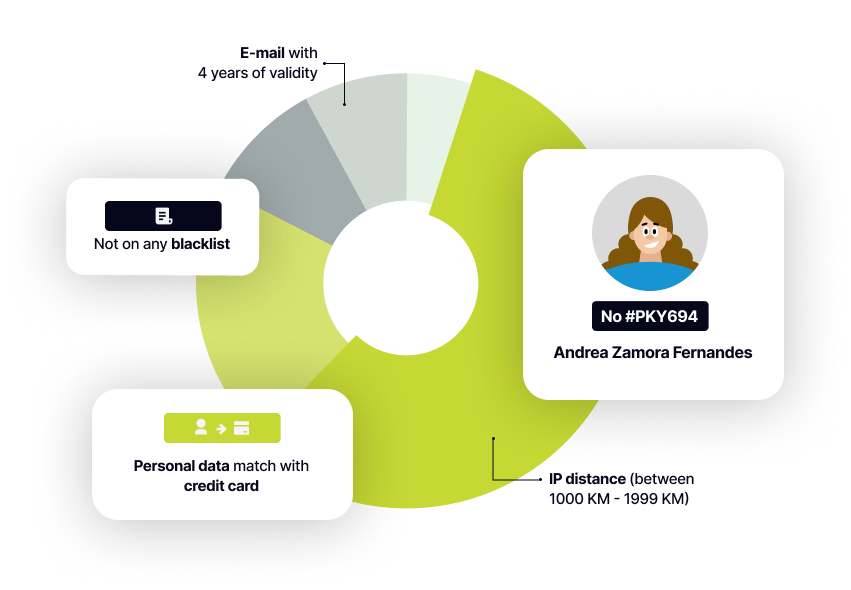

Know Your Customer (KYC) begins with collecting data and verifying that customers are who they say they are. When using KYC as an anti-fraud system, we verify the following customer information:

- Personal information

- Credit/debit card information

- Billing data

- Information about the device which made the purchase

- Other

How does Critical.net help you in the KYC process?

Knowing who your customers are is essential to create a safe business environment that steers clear of high-risk situations with authorities.

Critical.net helps you with the following:

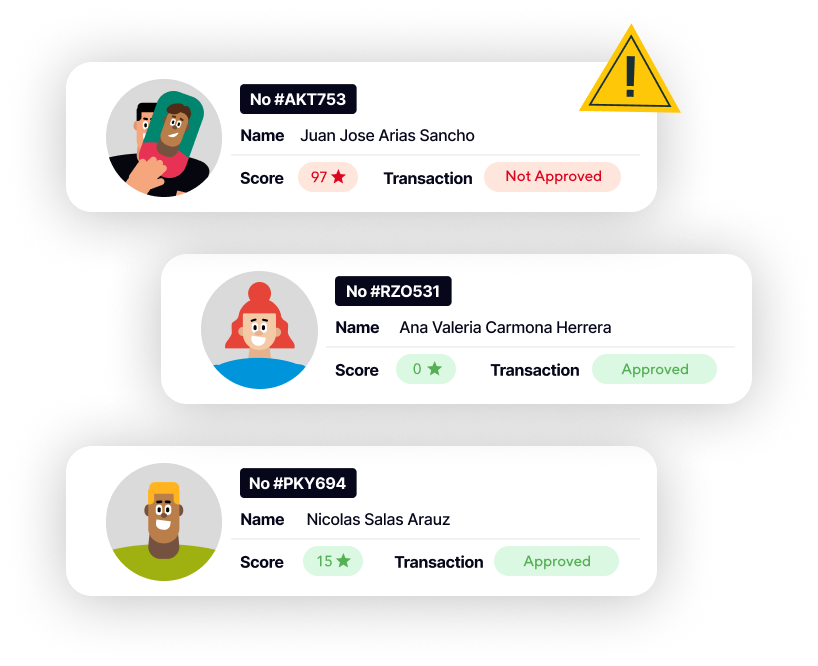

1. Rejection of high-risk orders

Critical.net stops high-risk orders from being processed to prevent chargebacks from any potential fraudulent order

2. Blacklist Comparison

The data provided by the buyer is run through our blacklist database to detect if they have previously committed any online scams

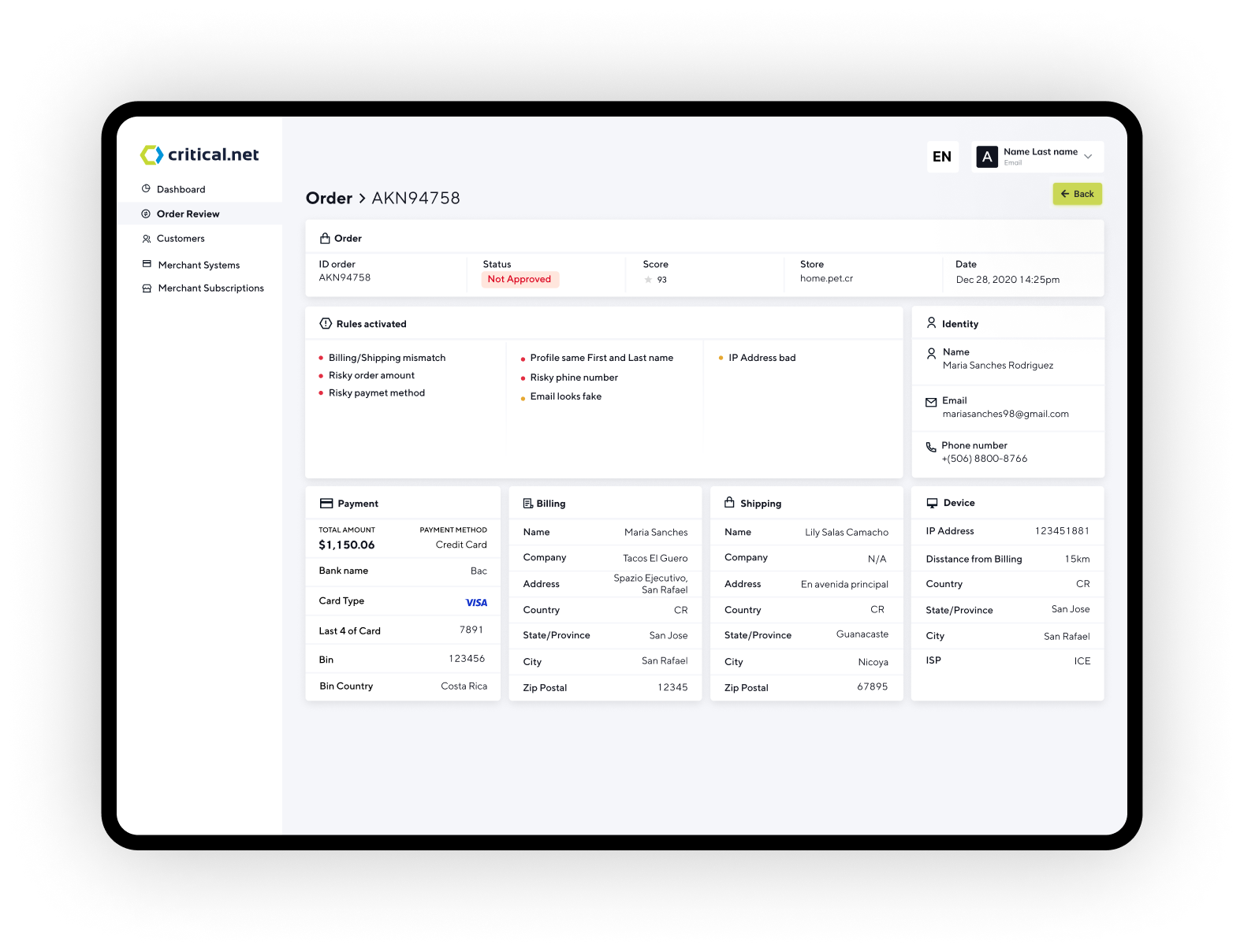

3. Dashboard with your client's information

We provide detailed information about your clients, warning you when there’s a risk and explaining why an order should not be taken

How does Critical.net help you in the KYC process?

Among the benefits and advantages of having a service that helps you Know Your Customer (KYC) for risk analysis in your orders, we provide you with the following:

Process optimization: Speed up the risk analysis process in your orders and thus reduce the number of manual reviews, automating the process.

Fast information: real-time data analysis of each order so you can make the best decisions on time.

Avoid scams: reduce the odds of your business being classified as high-risk in the eyes of banks or financial institutions, and avoid interrupting your business operations.

Savings: avoid overspending due to the consequences related to chargebacks.

Now that you know what a KYC is let us offer you a set of solutions to verify your client's identity in a way that adjusts to your business needs.

Know your Customer or KYC

Do you want to know more about how to protect

your online store?

Know-your-customer strategies can reveal a great deal of information about your audience and help you create a more comprehensive and

accurate anti-fraud system.

Would you like to learn more about Critical.net? Contact us now!